Secure Your Future. Start Today

Money Cornucopia simplifies complex personal finance into easy, actionable steps. Save better, invest smarter, and build lasting wealth without the stress.

Latest Insights

-

Stocks vs. Bonds: Are You an Owner or a Lender?

We’ve all been there: sitting at a coffee shop or scrolling through news headlines, hearing people talk about “the market.” It sounds like a secret club with its own language. But when you strip away the jargon and the complex charts, investing really boils down to just two roles you can play in the economy.…

-

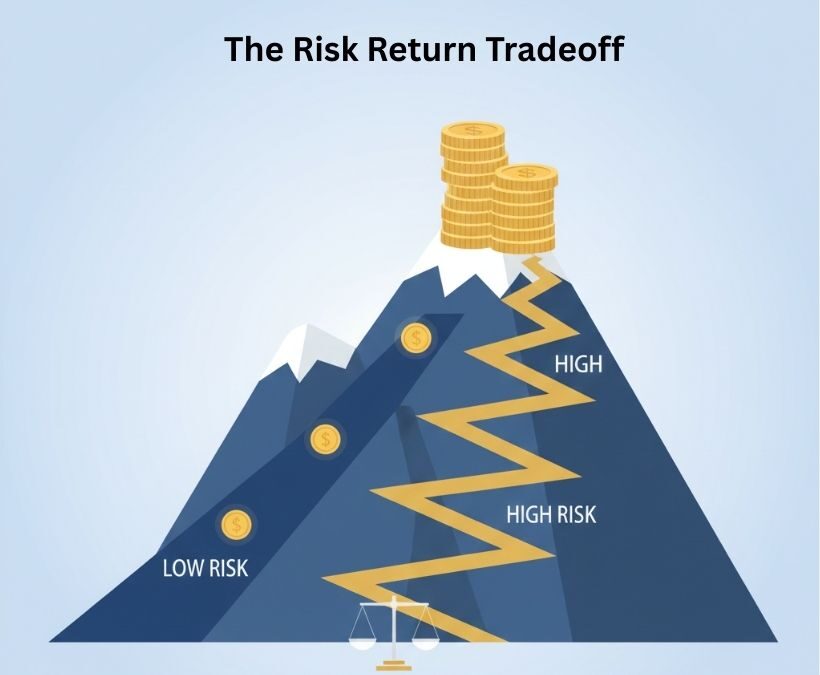

What is The Risk-Return Tradeoff: A Beginner’s Guide To Investing

The Age-Old Question: Can I Get Rich Without Taking Risks? Every aspiring investor asks the same question: “How can I grow my money without the fear of losing it all?” It’s a natural instinct to seek safety, especially when it comes to your hard-earned cash. Yet, if you’ve ever looked at a savings account statement,…

-

How One ‘Simple’ Finance Rule Built a $59 Billion Fortune (And Why Most Investors Missed It)

On March 2020, Michael Saylor—the brilliant CEO of MicroStrategy—stared at his balance sheet and felt a chill. At the time, he was sitting on $500 million in cash. He was rich—richer than 95% of the people in the U.S. But he wasn’t “Richie Rich” rich; he was the kind of rich that comes from decades…

-

How to Use Asset Allocation & Diversification to Grow Wealth

Imagine you are standing in a casino with your life savings in your pocket. A man in a suit approaches you and says, “I can give you a way to win more often, but here’s the catch: it also makes it much harder for you to lose everything.” In the world of gambling, that’s a…

-

What is Opportunity Cost? The Hidden Price of Every Choice

Have you ever felt like a $100 purchase actually cost you much more than $100? If you’ve been following our “Money Cornucopia” curriculum, you already know that Inflation makes your money shrink over time. But there is another “hidden price” that affects every single decision you make: Opportunity Cost. In the world of finance, every…

-

What is Inflation? A Beginner’s Guide to Purchasing Power

Have you ever walked into a grocery store and felt like your $100 bill just doesn’t buy as much as it used to? You aren’t imagining things. That “shrinking” feeling has a name: Inflation. At Money Cornucopia, we believe you shouldn’t need a PhD in Economics to understand your wallet. If Compound Interest is the…

-

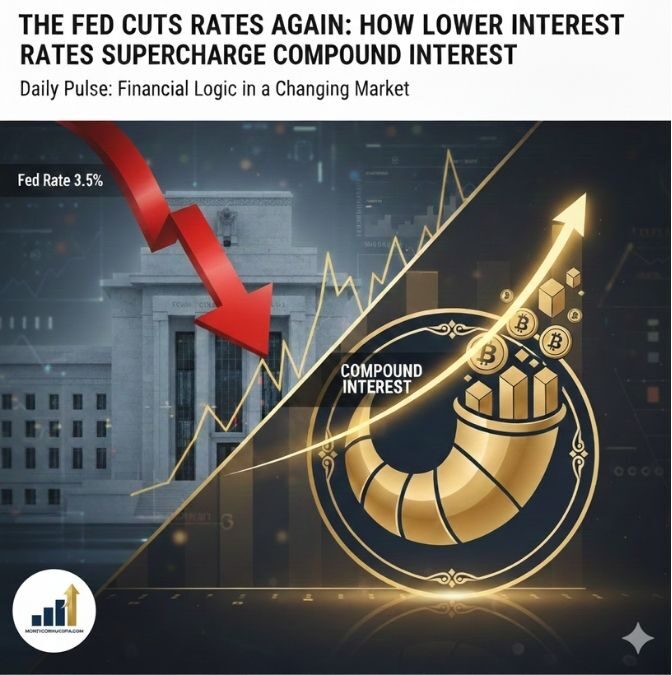

The Fed Cuts Rates Again: How Lower Interest Rates Supercharge Compound Interest

The Market Snapshot On Friday, December 19, 2025, the Federal Reserve officially lowered borrowing costs by another 25 basis points. This marks the third cut since September, pushing interest rates to their lowest levels since 2022. The “Financial Logic”: Why Rate Cuts Matter for Compounding In our recent post on Compound Interest, we learned that…

-

What is Compound Interest? The “Magic” Way to Grow Your Money

Albert Einstein, one of the smartest people to ever live, once called compound interest the “8th Wonder of the World.” He said, “He who understands it, earns it… he who doesn’t, pays it.” That sounds pretty serious, doesn’t it? But don’t worry—you don’t need a PhD in physics to get it. If you have ever…

-

Bitcoin Price Struggles at $86K: Is Extreme Fear a Buying Opportunity?

If you woke up today and felt a knot in your stomach checking the Bitcoin charts, you aren’t alone. As of December 18, 2025, the market has officially dipped into ‘Extreme Fear,’ with Bitcoin struggling to hold its ground at the $86,000 support level. But at Money Cornucopia, we believe that market volatility isn’t a…

-

Time Value of Money for Beginners: A Simple Guide | Money Cornucopia

Have you ever heard the phrase “Time is money”? Most people think it just means you shouldn’t waste your afternoon. But in the world of finance, it is a literal law of the universe. At Harvard, we call this the Time Value of Money (TVM), and it is the single most important secret to building…

-

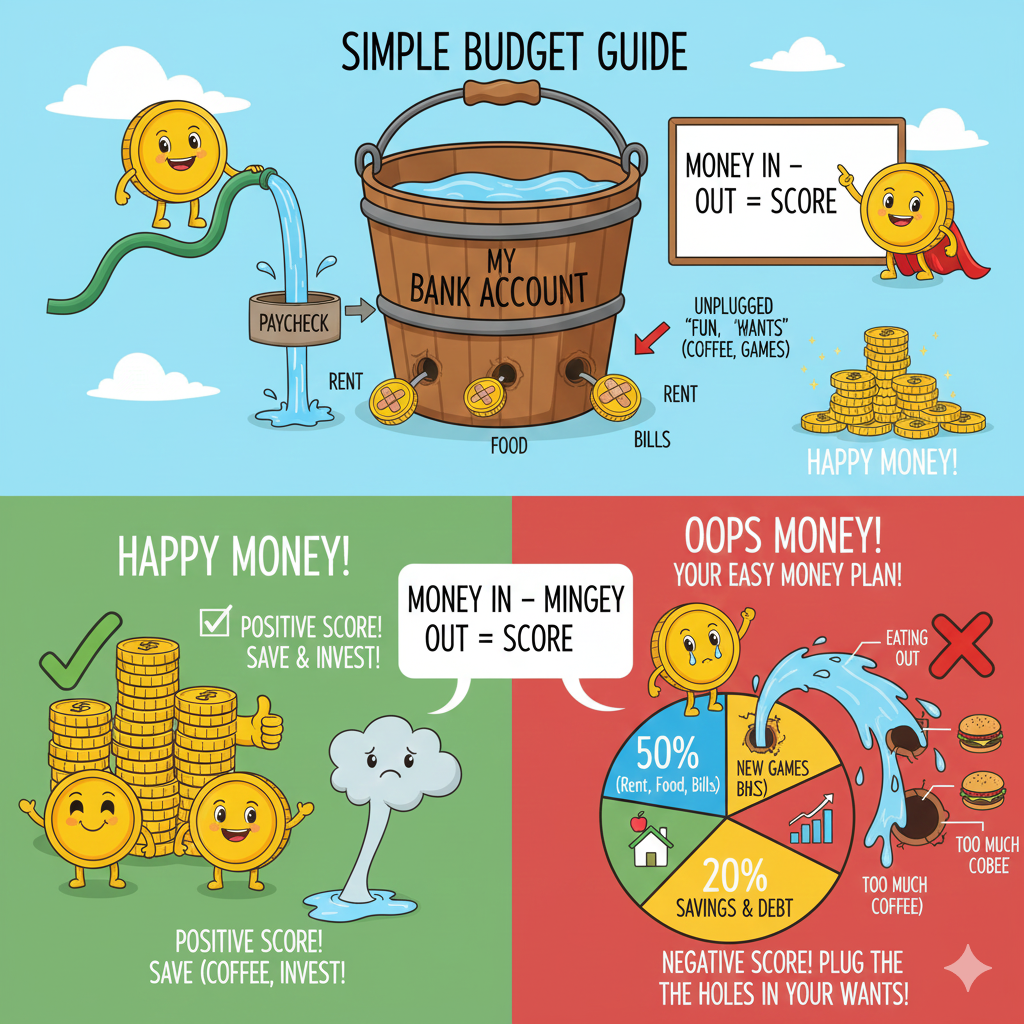

The Simple Budget Guide for Beginners: A Stupidly Easy 3-Step Plan

Ever Wonder Where Your Money Ran Off To? Do you ever get your money and then, just a few days later, you look at your bank account and it’s almost gone? It feels like a magic trick, but it’s not a fun one. Where did all that cash run off to? If this sounds like…