Albert Einstein, one of the smartest people to ever live, once called compound interest the “8th Wonder of the World.” He said, “He who understands it, earns it… he who doesn’t, pays it.”

That sounds pretty serious, doesn’t it? But don’t worry—you don’t need a PhD in physics to get it.

If you have ever felt like you are working too hard for your money and getting nowhere, it’s probably because you haven’t turned on your ‘Wealth Engine’ yet. This engine is powered by a concept called the Time Value of Money, and once you understand how it works, you’ll see why time is actually more valuable than the money itself.”

Imagine you are standing at the top of a snowy mountain. You pack a small handful of snow into a ball and give it a tiny push. At first, it moves slowly. But as it rolls, it picks up more snow. That extra snow makes the ball bigger, and because it’s bigger, it can pick up even more snow even faster. By the time it reaches the bottom, that tiny handful has become a giant, unstoppable boulder.

That is the “magic” of compounding. It’s not about how much money you start with; it’s about how that money starts making “babies,” and then those babies start making babies of their own.

In this blog, we’re going to pull back the curtain and show you exactly how this machine works so you can start building your own mountain of wealth today.

The Snowflake Effect: How Compound Interest Actually Works

Think of your first investment like a single, tiny snowflake. By itself, it doesn’t look like much. But compound interest is the “gravity” that turns that snowflake into an avalanche of wealth.

To understand how compound interest works, you have to think in “cycles.” In the first year, you earn interest on the money you originally put in (your “Principal”). But in the second year, something magical happens: you earn interest on your original money and on the interest you earned the year before.

It’s like your money is a little worker.

- Year 1: You have one worker. At the end of the year, he earns you a “baby” worker.

- Year 2: Now you have two workers (the original and the baby) both working to earn you more money.

- Year 3: They earn you even more workers!

Before you know it, you have an entire army of money-workers building your wealth for you. This is compounding interest explained at its simplest level: it is “interest earning interest.” The more time you give your army to grow, the faster it expands.

Simple Interest vs. Compound Interest: Why One is “Lazy” and the Other is a “Wealth Machine”

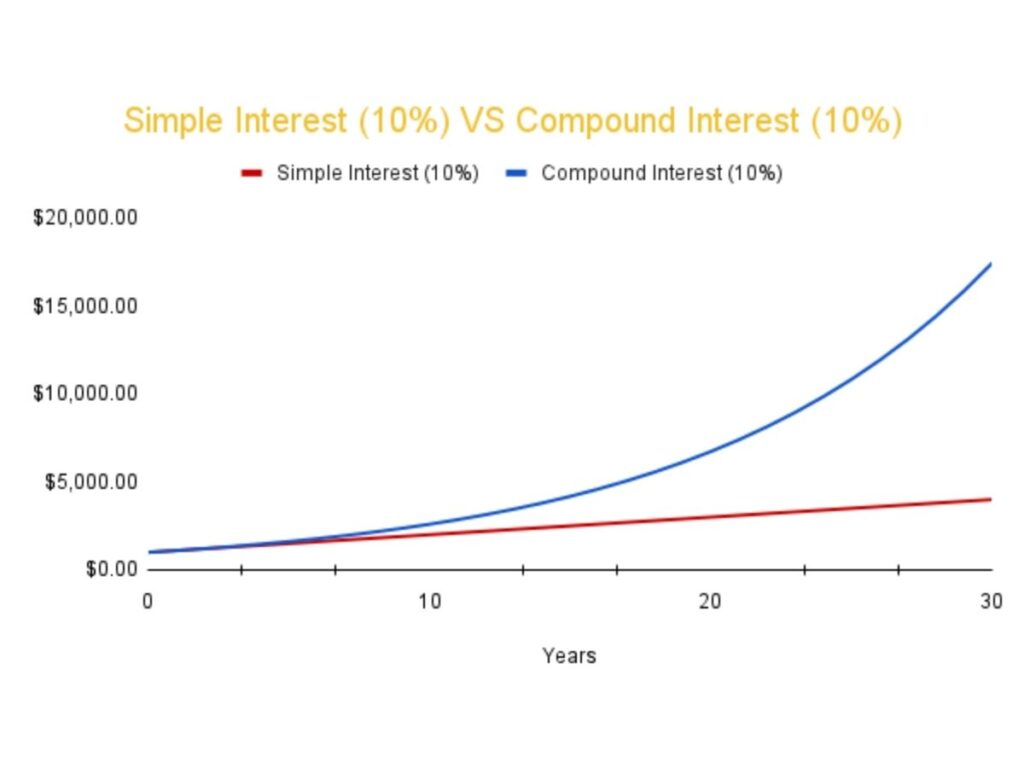

To truly understand compound interest vs simple interest, let’s imagine two friends: Lazy Larry and Smart Susan. Both start with $1,000.

Lazy Larry uses “Simple Interest.” Every year, his $1,000 earns him $50 in interest. Larry takes that $50 and puts it under his mattress. The next year, his $1,000 earns him another $50. No matter how many years go by, Larry only ever makes $50 a year. His money is “lazy”—it isn’t growing; it’s just standing still.

Smart Susan uses “Compound Interest.” In the first year, her $1,000 also earns $50. But instead of hiding it, she leaves it in the account. Now she has $1,050 working for her.

- Next year, she doesn’t just earn interest on her $1,000; she earns interest on that extra $50 too!

- Her money starts “stacking.”

In the beginning, the difference looks small. But after 20 years, Susan will have nearly double the money Larry has, even though they started with the exact same amount! Simple interest is like a ladder—you go up one step at a time. Compound interest is like a rocket ship—it starts slow, then clears the clouds and heads for the stars.

The Three Secret Ingredients of the Compounding “Recipe”

Think of compounding like baking a cake. If you miss one ingredient, the whole thing falls flat. To master the power of compounding, you need these three things in your kitchen:

1. Your Money (The Principal)

This is your “Starter Snowball.” The more snow you start with, the bigger the ball can get. However, as we saw with Sam and Alex in Lesson 1, you don’t need a fortune to start. Even a tiny “snowflake” can become an avalanche if you have the other two ingredients.

2. Your Percentage (The Interest Rate)

This is the “Speed” of your wealth machine. A 10% interest rate will grow your money much faster than a 2% rate. This is why we look for good investments rather than just letting money sit in a “lazy” piggy bank.

3. Your Superpower (Time)

This is the most important ingredient of all. In the world of finance, Time is more valuable than money. The longer you leave your money alone, the more “cycles” it has to multiply. If you give a small amount of money enough time, it will eventually do all the hard work for you.

We are making great progress! These next two sections are where the “magic” of Lesson 2 becomes practical. We’re going to give the reader a “superpower” (a math trick they can do in their head) and then show them a real-world story that proves why compounding is so powerful.

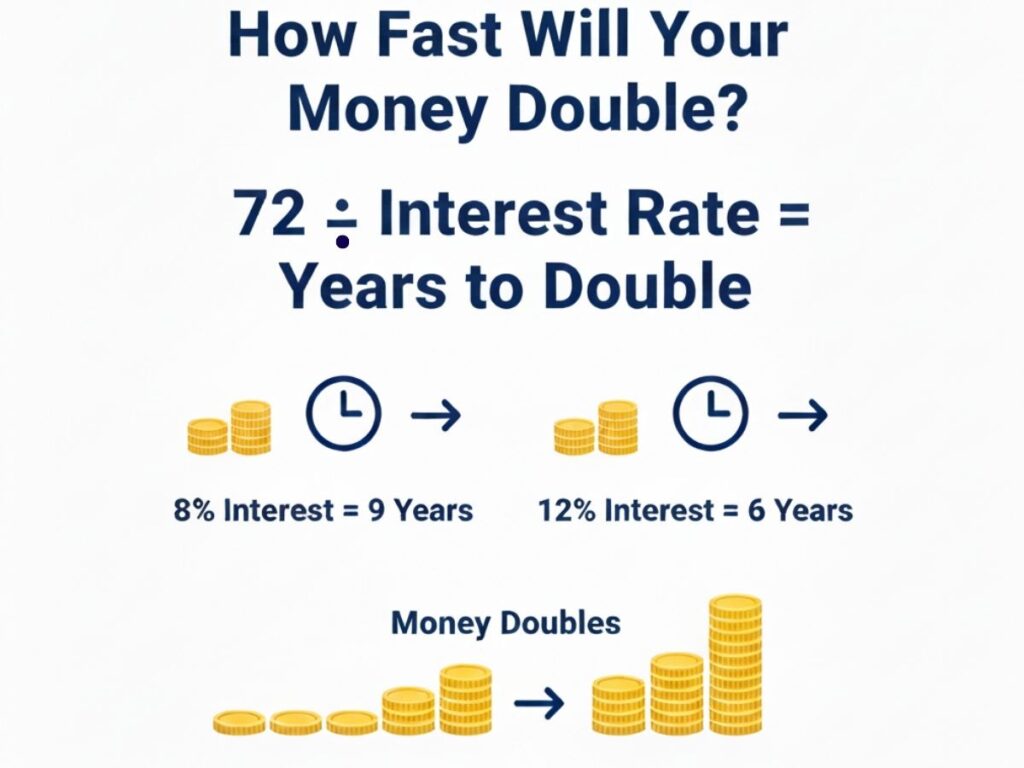

The Rule of 72: A Quick Mental Trick to Double Your Money

Have you ever wondered exactly how long it takes for your money to double? You don’t need a fancy calculator or a degree from Harvard to find out. There is a simple “brain hack” called The Rule of 72.

Here is how it works: Take the number 72 and divide it by the interest rate you are earning. The answer is the number of years it will take for your money to grow into twice its size.

- Example A: If you earn 7% interest, divide 72 by 7. In about 10 years, your $1,000 becomes $2,000.

- Example B: If you find a better investment at 10%, divide 72 by 10. Now, your money doubles in only 7.2 years!

This is a great way to see how even a small increase in your interest rate can shave years off your journey to wealth. It’s one of the first things experts teach when explaining what is compound interest for beginners because it makes the math feel like a game.

Real-Life Example: Watching $1,000 Explode Over 30 Years

To see the “Snowball Effect” in action, let’s look at a single $1,000 bill. Imagine you tuck it away in a “Wealth Machine” (like a low-cost index fund) that earns an average of 10% interest per year.

You don’t add any more money; you just let it sit. Here is what happens:

- Year 10: Your $1,000 has grown to $2,593. Not bad! You’ve more than doubled your money just by waiting.

- Year 20: This is where it gets exciting. Your money has grown to $6,727. Notice how it grew much more in the second ten years than the first? That’s the “babies having babies” effect.

- Year 30: Hold onto your hat. Your original $1,000 is now $17,449!

If you had used “Simple Interest” (like Lazy Larry), you would only have $4,000 after 30 years. But because you used compound interest, you have over $17,000. You didn’t work harder; you just let time and compounding do the heavy lifting for you.

To wrap up Lesson 2, we need to give your readers a clear “map” of what to do next. Most people feel inspired after learning about the “Magic Snowball,” but they get stuck because they don’t know the first step.

Here are the final two sections to complete your pillar post.

Action Plan: How to Put Your Money on Autopilot Today

Knowing how compound interest works is like having a map to a treasure chest—but you still have to walk the path! You don’t need a massive bank account to start your “Wealth Machine.” You just need to follow these three simple steps:

- Start Right Now (Even with $5): The “Superpower” of compounding is Time. A single dollar invested today is worth more than ten dollars invested ten years from now. Don’t wait for the “perfect” time; the best time was yesterday, and the second-best time is today.

- Automate Your Savings: Set up a “Set it and forget it” system. Most banks allow you to automatically move a small amount of money into an investment account every month. This ensures your “Snowball” keeps rolling even when you aren’t thinking about it.

- Leave the Snowball Alone: The biggest mistake people make is taking the money out too early. Remember: the “Magic” happens at the end of the journey, not the beginning. Let your money-workers stay on the job!

Can I lose money with compound interest?

Compounding itself is just math. However, if you invest in the stock market, the value can go up and down. That is why we give it Time to recover and grow.

Do I need to be good at Maths to calculate compound interest?

Not at all! There are thousands of “Compound Interest Calculators” online that do the work for you. You just need to understand the concept.

What is the best account for compounding?

For beginners, low-cost “Index Funds” or “High-Yield Savings Accounts” are great places to start your journey.

Is compound interest a scam?

No, it is a mathematical law of the universe! It is the same principle banks use to charge you interest on credit cards—only this time, the money is flowing into your pocket.

What is Compound Interest for Beginners? (Key Takeaways)

We’ve covered a lot of ground in this lesson. If you remember nothing else, keep these four “Golden Rules” of the magic snowball in mind:

- Compounding is a “Wealth Machine”: Unlike simple interest, compound interest makes your money work for you by earning interest on your interest. It’s the difference between walking up a hill and taking a rocket ship.

- Time is Your Greatest Asset: You don’t need a lot of money to start, but you do need a lot of time. Starting just a few years earlier can result in hundreds of thousands of dollars more in your pocket later.(This is the heart of the Time Value of Money—the longer you wait, the more “future value” you lose!)

- The “Rule of 72” is Your Shortcut: Whenever you see an interest rate, divide 72 by that number to see how quickly you can double your wealth. It’s the ultimate “cheat code” for investors.

- Patience is the Secret Ingredient: The biggest growth happens at the very end of the journey. Don’t melt your snowball by spending the money too early!

What’s Your First Move?

You are now officially ahead of 90% of the population when it comes to understanding how wealth is actually built. You have the map, and you have the engine. Now, it’s time to protect that wealth from the “thieves” of the financial world.

Leave a Reply