We’ve all been there: sitting at a coffee shop or scrolling through news headlines, hearing people talk about “the market.” It sounds like a secret club with its own language. But when you strip away the jargon and the complex charts, investing really boils down to just two roles you can play in the economy.

You are either an Owner or a Lender.

Think of your money as a tool for building your future. To use that tool effectively, you need to understand the materials you’re working with. In the world of finance, those materials are Stocks and Bonds.

One is built for speed and growth; the other is built for safety and stability. To build a portfolio that actually works, you have to decide which role fits your goals: the potential for high-speed growth or the comfort of a steady, predictable return.

In this post, we’re breaking down the simple logic behind these two building blocks so you can decide exactly how to mix them for your own financial success.

The “Lender” Role: How Bonds Work

Imagine your neighbor wants to start a lemonade stand. They need $100 for supplies, but they don’t have it. You decide to help them out by becoming a Lender.

When you buy a Bond, you are essentially giving a loan to a company or a government. In return, they give you a “I.O.U.” with a promise.

- The Deal: You give them your $100 today. They promise to pay you back that $100 in exactly one year, plus an extra $5 as a “thank you” (interest) for letting them use your money.

- The Safety Net: Even if the lemonade stand has a slow month, the neighbor is still legally obligated to pay you back your original $100 plus interest. This makes it a “Fixed Income” investment.

- The Downside: Your profit is capped. If the lemonade stand becomes a massive success and makes $1,000, you still only get your $105 back. You don’t share in the extra glory.

The “Owner” Role: How Stocks Work

Now, imagine a different scenario. You don’t want to just lend money; you want to be a part of the business. You decide to become an Owner.

When you buy a Stock, you are buying a tiny slice of a company. You own a piece of the “bricks and mortar.”

- The Deal: You give the neighbor $100. In exchange, you now own 10% of the lemonade stand forever.

- The Risk: There are no promises. If the lemons rot or no one is thirsty, the neighbor doesn’t owe you anything. You could lose your $100.

- The Reward: Your potential is unlimited. If the lemonade stand expands into a nationwide chain, your 10% “slice” of the business grows with it. That $100 investment could eventually be worth thousands.

Quick Comparison: Which One is Which?

| Features | Bonds (The Lender) | Stocks (The Owner) |

| Main Goal | Preservation & Income | Growth & Wealth |

| Predictability | High (You know what you’ll get) | Low (It can go up or down) |

| Priority | You get paid first | You get paid last |

| The “Vibes” | Calm and steady | Exciting and bumpy |

The “Why” Behind the Choice

Choosing between being an owner or a lender isn’t about picking a “winner.” It’s about picking the right tool for the job.

When to be a Lender (Bonds)

Bonds are for the “Defense” part of your game plan. You lean toward bonds when:

- You need the money soon: If you’re buying a house in two years, you don’t want your down payment swinging 20% up or down in the stock market.

- You prioritize sleep over excitement: If market volatility causes you physical stress, a higher bond count acts as a shock absorber for your emotions.

- You want a steady “Paycheck”: Retirees often love bonds because they provide regular interest payments (called coupons) that act like a steady stream of income.

When to be an Owner (Stocks)

Stocks are for the “Offense.” You lean toward stocks when:

- You have time on your side: If you’re 25 and won’t touch this money for decades, you can afford to let the “lemonade stand” go through a few rainy seasons because you know the sunny years will likely make up for it.

- You want to beat inflation: If you just keep cash in a drawer, it loses value over time as prices go up. Stocks have historically been the best way to outrun the rising cost of living.

- You want to participate in innovation: Being an owner means you profit from the world’s best ideas and hardest-working companies.

The “Priority” Secret

Here is one thing most people don’t realize: Lenders get paid first. If a company runs into trouble and has to close its doors, the law says they must pay back their debts (the Bondholders) before the owners (the Stockholders) get a single penny. This is why stocks are riskier—you are the last person in line to get paid, but if the company is a success, you get the biggest share of the pie.

Finding Your Perfect Mix: Putting the Concepts Together

Now that you know the difference between being an owner and a lender, the big question is: How much of each should you have?

Finding the right mix is where the Risk-Return Tradeoff comes into play. As we’ve seen, you generally can’t have high returns without taking on the higher risk of ownership. Conversely, the safety of being a lender usually comes with lower growth.

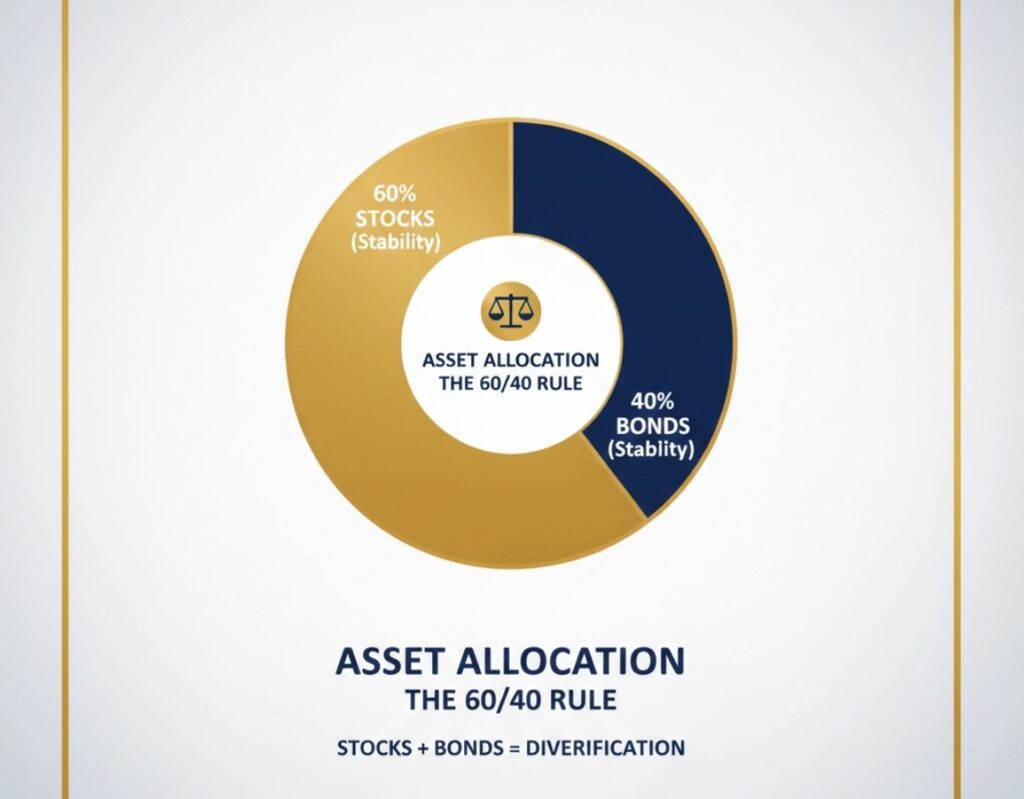

This is why Diversification is your best friend. By holding both stocks and bonds, you aren’t just “guessing”—you are building a balanced structure. When the stock market is volatile, your bonds act as the stabilizer. When inflation rises, your stocks act as the engine.

The Traditional 60/40 Rule

For decades, many investors used a simple “Gold Standard”: 60% Stocks and 40% Bonds. * The 60% in Stocks provides the growth to build wealth.

- The 40% in Bonds acts as the anchor, keeping the ship steady when the stock market gets stormy.

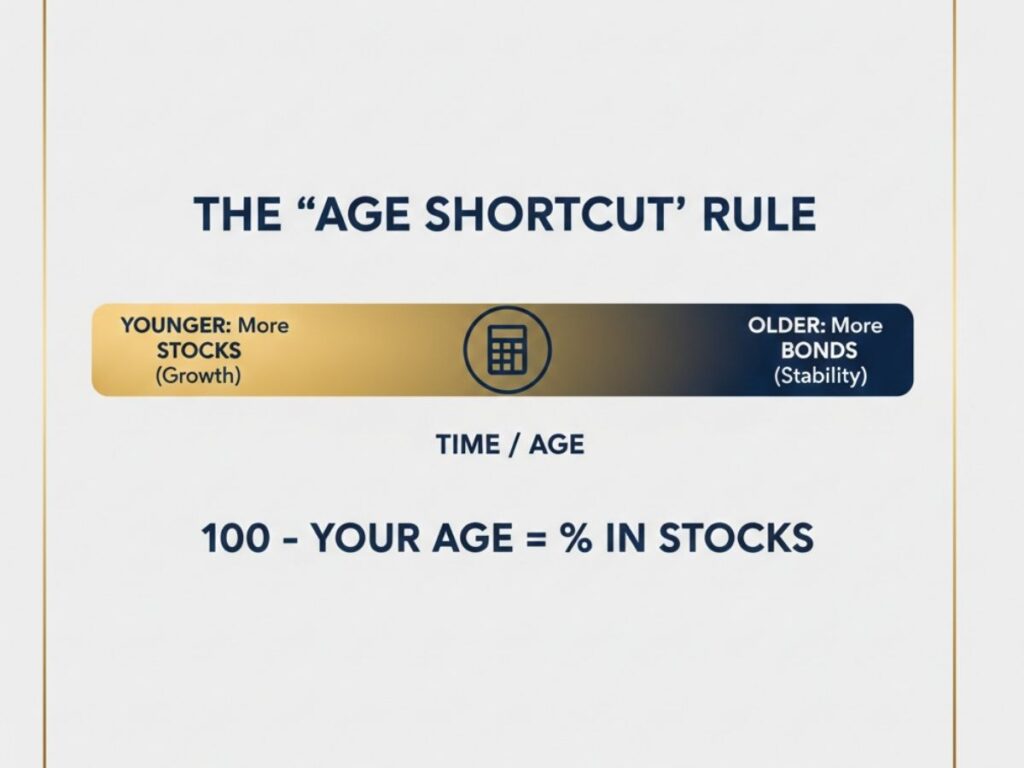

The “Age” Shortcut

A common rule of thumb is to “Subtract your age from 100.” The result is the percentage of your portfolio that should be in stocks.

- Example: If you are 30 years old, you might hold 70% in stocks and 30% in bonds.

- As you get older, you slowly shift more toward bonds to protect the wealth you’ve already built.

Conclusion: Designing Your Future

There is no “one size fits all” answer. The right mix depends entirely on your own timeline and your personal comfort with risk.

Whether you choose to be a bold Owner chasing the next big innovation or a cautious Lender seeking steady security, the most important step is simply getting started. By understanding how these two building blocks work together, you are no longer just “playing the market”—you are an architect, intentionally designing a future that belongs to you.

Frequently Asked Questions (FAQs)

Which is better for beginners: stocks or bonds?

There isn’t a “better” one, but most beginners start with a mix. If you are young and looking to grow your money over many years, you might lean more toward stocks. If you are nervous about the market and want to see how things work first, starting with bonds or a “balanced fund” can help you get your feet wet without the high drama of price swings.

Can I lose all my money in bonds?

It is much harder to lose everything in bonds than in stocks, but it isn’t impossible. This usually only happens if the company or government you lent money to goes bankrupt (called a “default”). This is why many people stick to “Government Bonds” or “Investment Grade” corporate bonds—they are considered much safer “lenders.”

Do I have to pick individual stocks and bonds myself?

Not at all! In fact, most people don’t. You can buy “bundles” of stocks or bonds through things like Mutual Funds or ETFs. This allows you to be an “Owner” or a “Lender” to hundreds of companies at once, which automatically helps with your Diversification.

How often should I change my mix of stocks and bonds?

You don’t need to check it every day. Most people review their mix once a year. As you get closer to a big goal (like retirement or buying a house), you might slowly move more money from the “Owner” side (stocks) to the “Lender” side (bonds) to lock in your gains and reduce risk.

Do stocks and bonds always move in opposite directions?

Usually, when the stock market goes down, bonds go up (or stay steady) because investors run to safety. However, this isn’t a perfect rule. There are times when both can go down at once, which is why having a clear plan and a long-term view is so important.

Leave a Reply