Ever Wonder Where Your Money Ran Off To?

Do you ever get your money and then, just a few days later, you look at your bank account and it’s almost gone? It feels like a magic trick, but it’s not a fun one. Where did all that cash run off to?

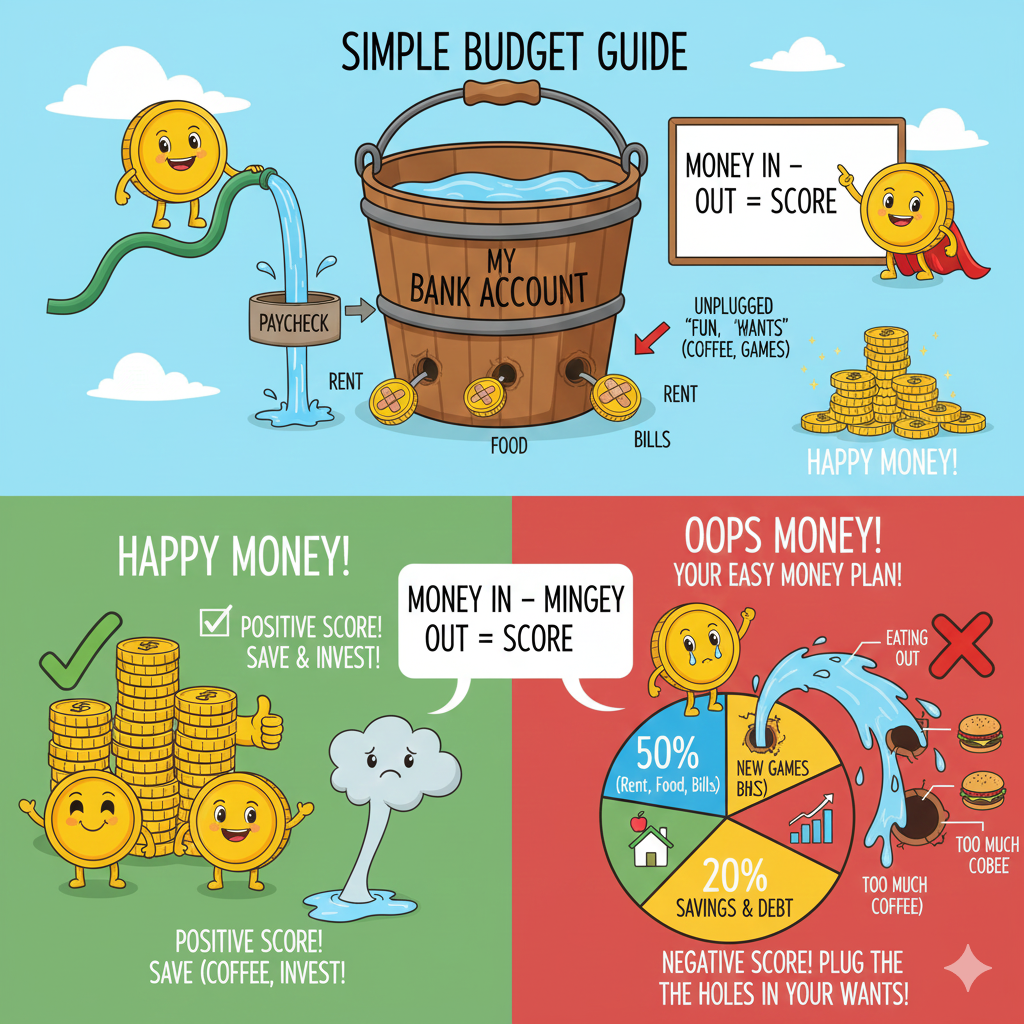

If this sounds like you, you need a simple budget guide. A budget is just a plan for your money, and we are here to show you a super easy way to start. This is the ultimate simple budget guide for beginners.

The secret to making your money last is knowing exactly where it goes. And trust me, you can totally do this!

Budgeting is Just “Money Tracking”

A budget is just a fancy name for writing down what money you get and what money you spend. That’s it! If you want to know where your money goes every month, this simple “money tracking” is the answer.

Here’s the simple idea using our simple budget guide:

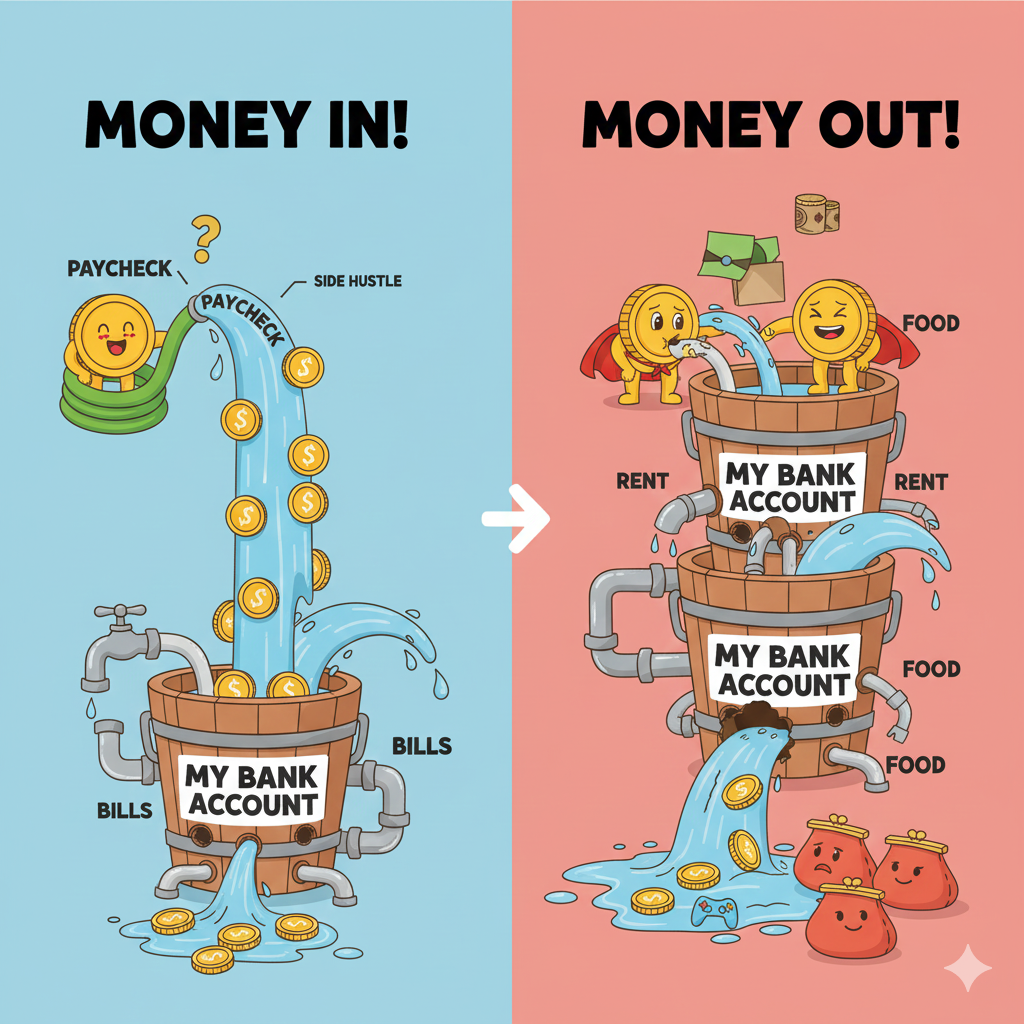

Imagine your bank account is a bucket.

- The money you get (your paycheck) is the water coming in.

- The money you spend (rent, food, fun) is the water going out.

Your goal is simple: Make sure the water coming in is always more than the water going out.

When the money coming in is bigger, you have a good cash flow, and that gives you control. Now, let’s get to the plan!

The Stupidly Simple 3-Step Budget: Your Best Simple Budget Guide

Ready to make your simple budget guide a reality? This plan is so easy, you only need to look at three things. Remember, we are just trying to know where your money goes.

Here are the three steps to start budgeting for beginners right now:

Step 1: Count Your Buckets (What Money Comes In?)

This is the fun part! You need to figure out how much money is coming into your bucket every month.

- The Action: Add up all the money you expect to get this month. This includes your paychecks, any money from a side job, or anything else you earned.

- The Big Number: Write down that final number. This is your total Monthly Income.

- Simple Analogy: This is the size of the hose filling your bucket. If the hose is bigger, you get more water! If you get paid on different dates, just try to get a good guess of the total amount.

Step 2: Spot the Leaks (What Money Goes Out?)

Now, we look at the spending—the leaks in your bucket. We will break them into two simple groups:

- A. The Need-to-Haves (The Tapes): These are the bills you MUST pay to live. You can’t skip these.

- Examples: Rent/mortgage, minimum loan payments, groceries, and essential utilities (like water and electricity).

- B. The Want-to-Haves (The Holes): These are things you spend money on that are optional. You could live without them, but they are fun!

- Examples: Eating out at restaurants, new video games, streaming services (like Netflix), or expensive coffee.

The Action: Add up the total cost of all your Need-to-Haves and all your Want-to-Haves. This is your total Monthly Spending.

IMPORTANT: Fixed Money vs. Wobbly Money

When you know where your money goes, you will see that some bills are the same every month, and some change.

- Fixed Money: This money is spent on bills that are exactly the same every single month. Your rent is a great example. They are easy to track!

- Wobbly Money: This money is spent on things that change every month, like food or gas for your car. You need to pay attention to these, because they are the sneakiest leaks!

Step 3: Check the Score! (Do you have “Happy Money” or “Oops Money”?)

This is the moment of truth! We simply take the money that came in and subtract the money that went out.

Money In – Money Out = The Score

- If the Score is POSITIVE: You have “Happy Money”! This means you have extra cash left over. Great job! You can use this money to save, invest, or pay off your debt faster.

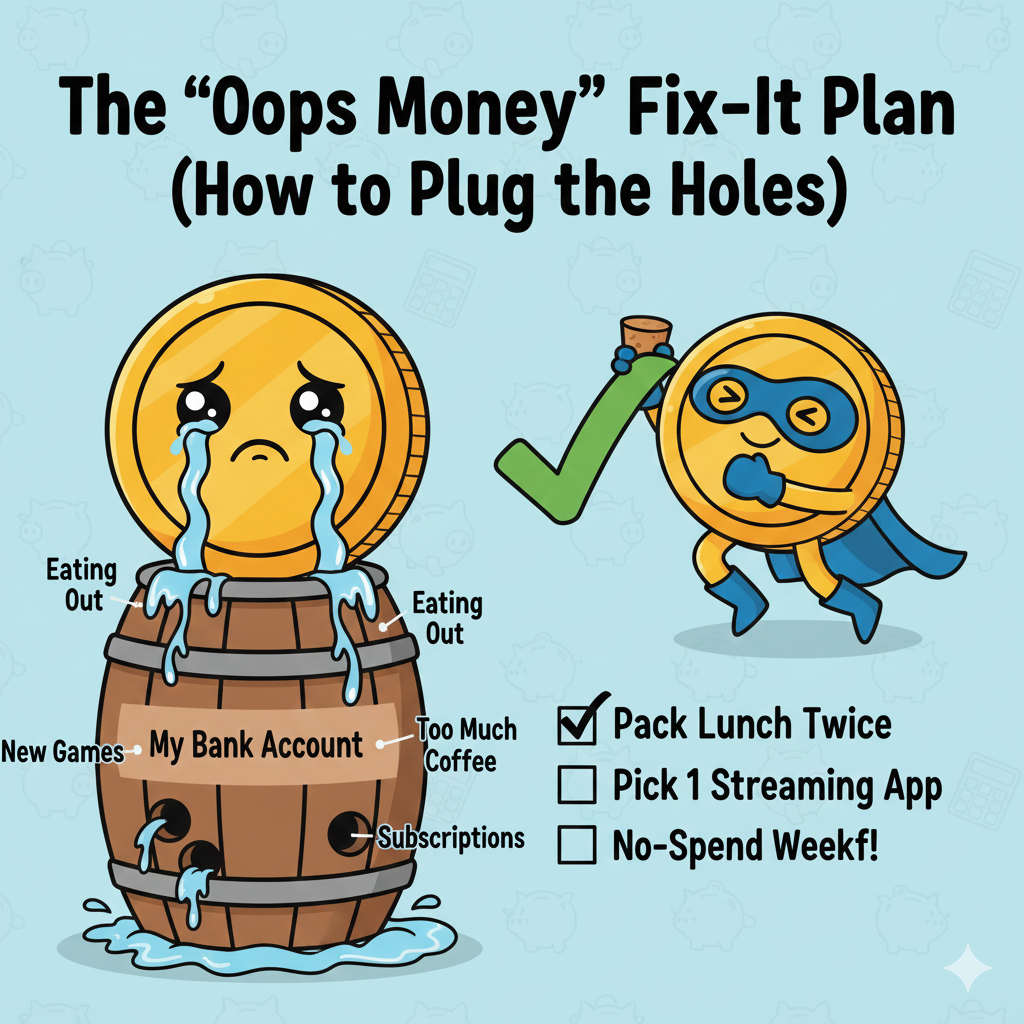

- If the Score is NEGATIVE: You have “Oops Money”. This means your bucket is emptying too fast! Don’t panic. You now know where your money goes.

The “Oops Money” Fix-It Plan (How to Plug the Holes)

If your score is negative, the most important thing you can do is find some holes to plug in your Want-to-Haves list!

- Challenge Your Wants: Look at your Wobbly Money. Did you eat out too many times? Try packing your lunch for two weeks instead.

- Cut the Extras: Do you have three different movie streaming services? Maybe just pick one this month.

- Pause Spending: Decide not to buy anything “optional” for one week. Move that saved money right into your bucket to fix the score.

This is what a simple budget guide is all about: taking action to get your score to “Happy Money”!

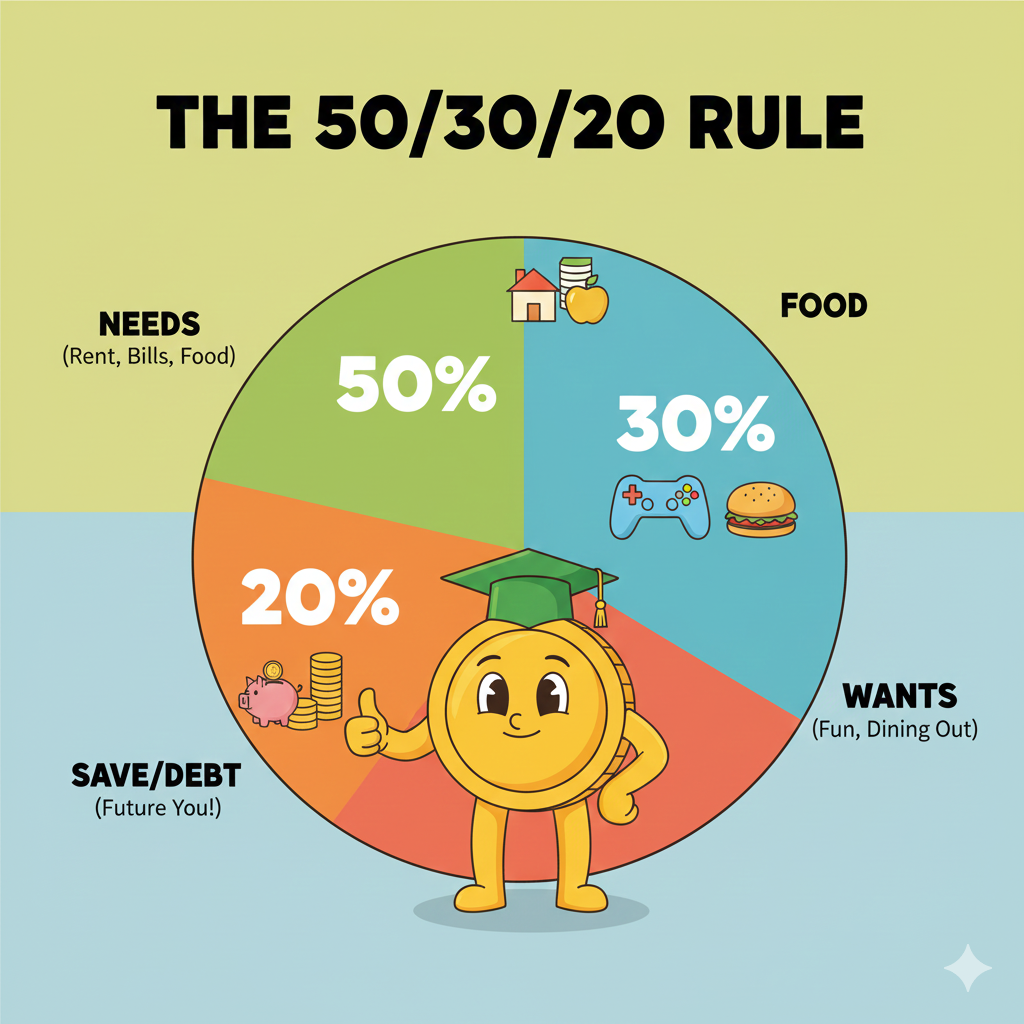

Pro Tip: The 50/30/20 Rule for Easy Planning

Once you have your three steps figured out, here is a secret rule to make things even easier. It’s called the 50/30/20 Rule, and it’s a favorite simple budget guide for many people.

This rule just helps you divide your paycheck right away:

- 50% for Needs: Half of your money should go to your Need-to-Haves (rent, food, bills).

- 30% for Wants: A little less than a third of your money can go to your Want-to-Haves (fun stuff, eating out).

- 20% for Saving/Debt: This is the most important part! At least one-fifth of your money should go straight into saving for your future or fighting the Money Monster (debt).

Don’t worry if you can’t hit these numbers exactly right now. It is just a great, simple goal to aim for as you keep practicing your money tracking.

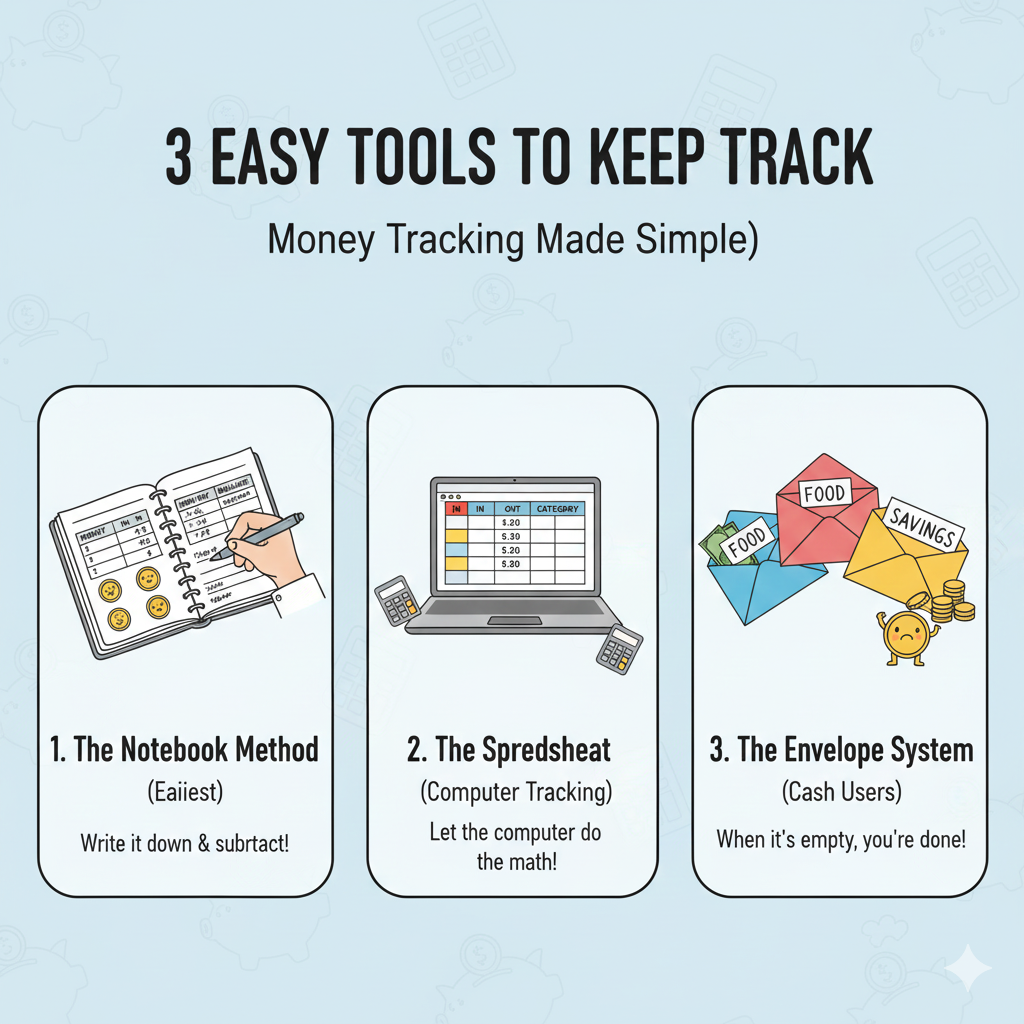

3 Easy Tools to Keep Track of Your Bucket (Money Tracking Made Simple)

You don’t need a fancy math degree to track your money! All you need is a simple way to write down your income and spending.

- The Notebook Method (Easiest): Just grab a notebook and a pen. Write your “Money In” at the top of the page, and every time you spend money, write it down and subtract it. It’s the most straightforward way to start budgeting for beginners.

- The Spreadsheet (Computer Tracking): If you like typing, use a simple Google Sheet or Excel file. This lets the computer do the subtraction for you. You can label one column “In” and another column “Out.”

- The Envelope System (Cash Users): If you use cash, put the cash for each “Want-to-Have” (like entertainment) into separate envelopes. When the envelope is empty, you are done spending for that category until next pay day!

You Just Started! Take Control Today!

Congratulations! You just finished your first simple budget guide. Remember, budgeting is not about feeling poor; it’s about giving you control over your money and feeling smart!

Now that you know where your money goes, you can decide where you want it to go.

If you want to read more about how to make smart money choices every day, we recommend this great article on 5 Ways to Improve Your Financial Health by a trusted financial resource.

If your score was “Happy Money,” you can start using that extra cash to fight debt! Learn how to attack big bills in our post about [The Silent Money Monster](Internal Link to Debt Post).

Leave a Reply