The Age-Old Question: Can I Get Rich Without Taking Risks?

Every aspiring investor asks the same question: “How can I grow my money without the fear of losing it all?” It’s a natural instinct to seek safety, especially when it comes to your hard-earned cash. Yet, if you’ve ever looked at a savings account statement, you’ve probably felt that nagging doubt – your money isn’t really growing, it’s just sitting there. This brings us to one of the most fundamental concepts in finance: The Risk-Return Tradeoff.

In this beginner’s guide, we’re going to demystify this critical relationship. You’ll learn why you cannot have high investment returns without accepting a certain level of uncertainty, and more importantly, how to navigate this balance to build a strategy that aligns with your comfort level. Forget complex jargon; we’ll break down the “cost of admission” to wealth building and show you how to make informed decisions about your money’s future. Ready to understand the core dynamic of investing? Let’s dive in.

The “Price of Admission” to Wealth

Think of the Risk-Return Tradeoff as a see-saw. On one side, you have your Potential Return (how much money you could make). On the other side, you have Risk (the chance that you could lose money or that things won’t go as planned).

In the world of investing, these two are physically linked. You cannot push the “Return” side up without the “Risk” side rising as well.

The Three Levels of the “Ladder”

To make this easy to understand, imagine your money is on a ladder. The higher you climb, the better the view, but the more the ladder shakes.

- The Bottom Rung (Cash & Savings): Very sturdy. No shaking. But you’re barely off the ground. After inflation, you might actually be losing “buying power.”

- The Middle Rung (Bonds): You’re higher up now. You can see more growth, but there’s a slight breeze. You’re lending money to a company or government for a steady “thank you” fee (interest).

- The Top Rung (Stocks): The view is incredible. This is where real wealth is built. However, the ladder shakes when the wind blows (market volatility). To enjoy the view, you have to be okay with the shaking.

Key Takeaway: Risk isn’t a “mistake” you made; it is the fee you pay for the opportunity to grow your wealth.

Excellent. Now that the reader understands that risk is a “fee” for growth, we need to address the most practical question: “How much risk should I actually take?” This part of your syllabus—The Risk-Return Tradeoff—is personal. What is right for a 22-year-old isn’t right for a 65-year-old.

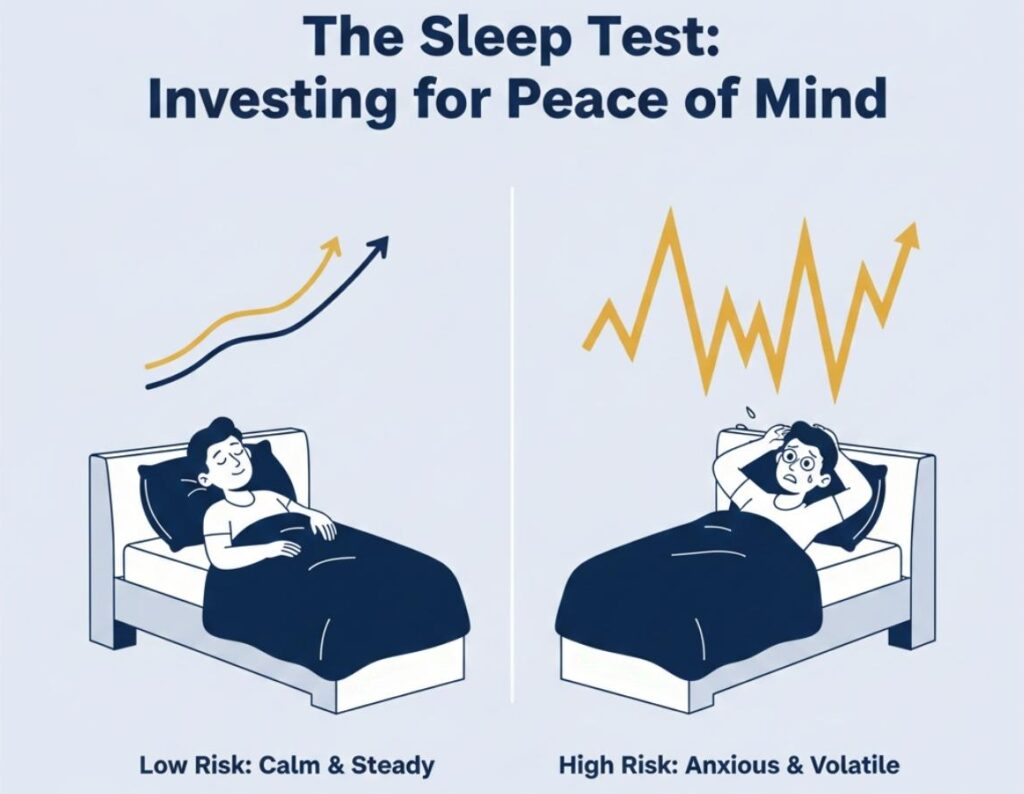

Finding Your “Sleep at Night” Factor

In the financial world, we call this your Risk Tolerance. It’s basically a measure of how much your investments can drop in value before you start panicking and want to sell everything.

To find your balance, you need to look at two things:

1. Your Time Horizon (The “When”)

This is the most important factor.

- Long-term (10+ years): You can take High Risk. If the market crashes tomorrow, you have a decade for it to bounce back. You can afford the “zigzag” path.

- Short-term (1-3 years): You should take Low Risk. If you need that money for a house down payment next year, you can’t afford a market dip today.

2. Your Emotional Stomach (The “Who”)

Imagine waking up and seeing that your $10,000 is now worth $8,000.

- Do you say, “Great! Stocks are on sale, I’ll buy more!”? (High Risk Tolerance)

- Or do you get a pit in your stomach and lose sleep? (Low Risk Tolerance)

The “Golden Rule” of the Tradeoff

The goal isn’t to take the most risk; it’s to take the right amount of risk to hit your goals without causing you to quit when things get bumpy.

Real-World Examples

Let’s look at how this tradeoff looks in real life with three common “investing personalities”:

- The “Safety First” Saver: Puts money in a high-yield savings account.

- Risk: Near zero.

- Return: ~4%.

- The Catch: Might not keep up with the rising cost of living (inflation).

- The “Balanced” Builder: Uses a mix of 60% stocks and 40% bonds.

- Risk: Moderate.

- Return: ~6-8% historically.

- The Catch: Some ups and downs, but generally smoother.

- The “Aggressive” Accumulator: Invests 100% in a Diversified Stock Index Fund.

- Risk: High.

- Return: ~10% historically.

- The Catch: Must be prepared to see the “value” drop by 30% or more in a bad year.

Excellent plan. A strong conclusion and an FAQ section are crucial for both reader retention and SEO. The FAQ can be a goldmine for long-tail keywords.

Conclusion: Your Personal Balance

Understanding the Risk-Return Tradeoff isn’t about picking the riskiest investment possible. It’s about finding your personal sweet spot where your potential for growth meets your comfort level with uncertainty. Your financial journey is unique, and so should be your approach to risk.

As you move through the “Architecture of Wealth” curriculum, remember that smart investing isn’t about avoiding all risk—it’s about understanding it, managing it, and using it strategically to achieve your long-term goals. Don’t let fear paralyze you, but also don’t let greed blind you. Find the balance that allows your money to work hard for you, while still letting you sleep soundly at night.

Frequently Asked Questions

What is the main difference between “risk” and “volatility” in investing?

Risk is the chance of permanently losing your money or not achieving your financial goals. Volatility is simply how much an investment’s price goes up and down over a short period. A volatile investment isn’t always risky if you have a long time horizon; its price swings might just be temporary.

Is there any investment with absolutely no risk?

Almost none. Even cash in a bank account carries inflation risk (your money buys less over time) and, in very rare cases, bank default risk (though most countries have insurance like FDIC/FSCS). Every investment has some form of risk, however small.

Does taking more risk always guarantee higher returns?

No, it doesn’t guarantee anything. It only gives you the potential for higher returns. Sometimes, a high-risk investment can result in significant losses. The key is understanding that greater potential reward comes with greater potential for loss.

How does my age affect my risk tolerance?

Generally, younger investors with a longer time horizon (many years until retirement) can afford to take more risk because they have more time to recover from market downturns. As you get closer to needing your money, it’s wise to reduce your risk exposure to protect your capital.

Can diversification reduce risk?

Yes, absolutely! Diversification is often called the “only free lunch in finance” because it allows you to reduce non-systematic risk (the risk specific to one company or industry) without necessarily reducing your potential returns. By spreading your investments across different assets, you minimize the impact if one particular investment performs poorly.

Key Takeaways: The Architecture of Risk

If you only remember three things from this lesson, let it be these:

- Risk is the “Price of Admission”: You cannot achieve high growth without accepting some uncertainty. If an investment promises “high returns with zero risk,” it is likely a scam.

- Time is Your Best Friend: The longer your “Time Horizon” (how long you can leave the money alone), the more risk you can afford to take.

- Personal Comfort Matters: The best investment strategy is the one you can stick to. If your portfolio is so risky that you can’t sleep, it’s time to rebalance.

Leave a Reply