Have you ever heard the phrase “Time is money”?

Most people think it just means you shouldn’t waste your afternoon. But in the world of finance, it is a literal law of the universe. At Harvard, we call this the Time Value of Money (TVM), and it is the single most important secret to building wealth.

If I offered to give you $1,000 today or $1,000 exactly one year from now, which would you choose?

Your gut probably tells you to take the money now. You’re right—but do you know why? It’s not just because you’re impatient. It’s because that $1,000 today has a “superpower” that the future $1,000 doesn’t have yet.

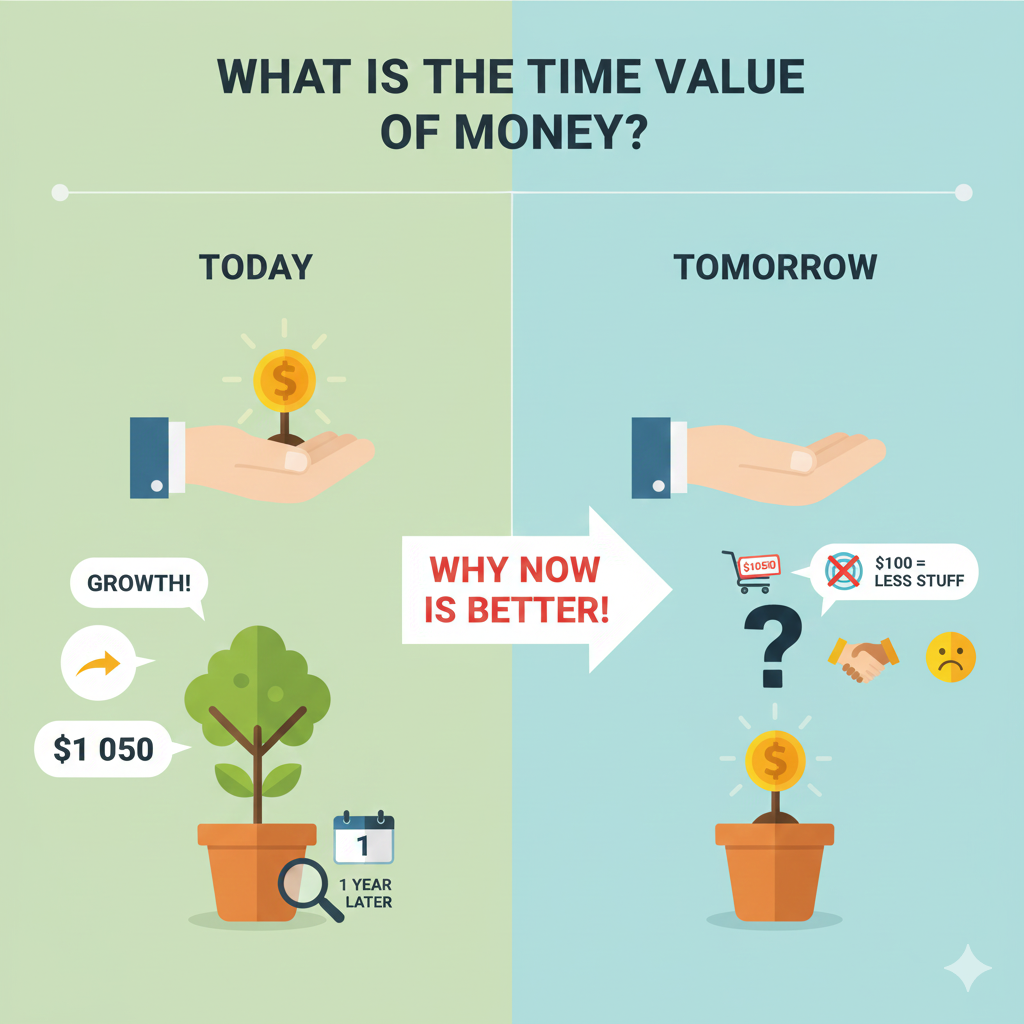

What is the Time Value of Money? (TVM Explained Simply)

At its core, the Time Value of Money is the idea that money you have right now is worth more than the same amount of money in the future.

Think of money like a seed. If I give you a seed today, you can plant it immediately. By next year, you have a small tree. If I wait a year to give you the seed, you’re starting from zero while the other person already has shade and fruit.

There are three main reasons why “now” is always better than “later”:

The Growth Engine (Opportunity Cost): Money in your hand can be invested to earn interest. If you put $1,000 in a savings account at 5% interest, you’ll have $1,050 next year. By waiting for the money, you literally “lose” that $50.

The Silent Thief (Inflation): Prices usually go up over time. What $100 buys at the grocery store today is almost always more than what $100 will buy five years from now.

The Risk Factor (Uncertainty): A lot can happen in a year. The person who promised you the money might change their mind, or the economy might shift. Cash in your pocket today has zero “waiting risk.”

How the “Wealth Machine” Works

You don’t need to be a math genius to use TVM. You just need to understand how four pieces of a puzzle fit together to create a “Future Value.”

- Present Value (PV): This is your starting point. The cash you have right now.

- Interest Rate (r): This is the “speed” of your growth.

- Time (n): This is the “fuel.” The longer you leave your money alone, the more powerful it becomes.6

- Future Value (FV): This is the “destination”—the amount your money will grow into.7

Professor’s Note: If you want to see the math in action, the basic formula is

8$FV = PV \times (1 + r)^n$.9

But don’t let the symbols scare you. All it’s saying is: Money x Growth x Time = Wealth.

3 Ways TVM Changes Your Life Every Day

You might not see it, but the “Time Value” rule is working behind the scenes of every dollar you spend or save. Here are three ways it affects you:

1. The “Early Bird” Secret (Retirement)

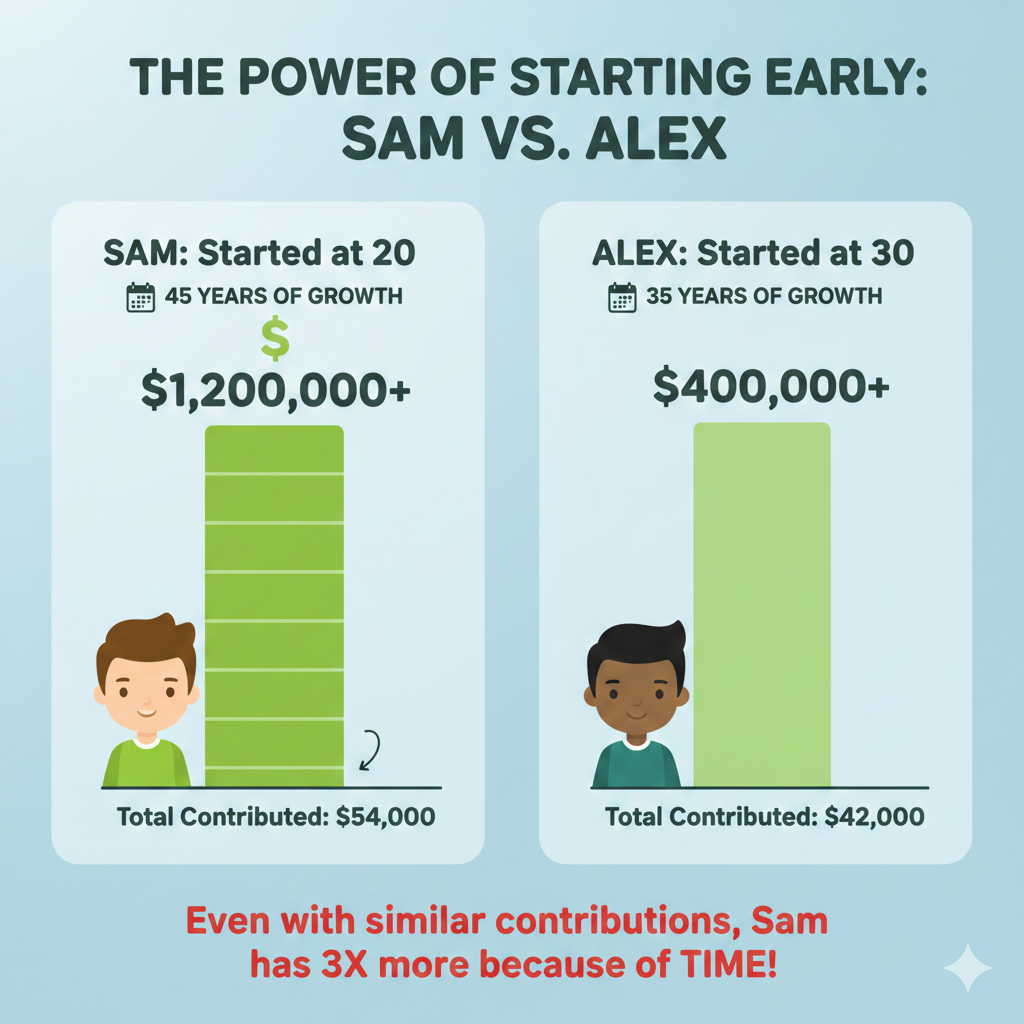

Imagine two friends, Sam and Alex.

- Sam starts saving $100 a month when he is 20 years old.

- Alex waits until he is 30 to start saving the exact same amount.

Even though Alex only waited 10 years, Sam will end up with way more money by the time they retire. Why? Because Sam’s money had more “Time” to use its growth superpower. In finance, time is like a magnifying glass—the longer you wait, the bigger the numbers get.

2. The “Sneaky Thief” (Inflation)

Have you ever heard your grandparents say, “Back in my day, a movie ticket cost a nickel!”?

That is TVM in reverse. Because of inflation, the value of a dollar usually goes down over time. If you hide $100 under your mattress for 20 years, it will still say “$100” on the bill when you take it out, but it will buy much less food than it does today.

- The Lesson: To beat the “thief,” your money needs to grow faster than prices rise.

3. The “Danger of Later” (Credit Card Debt)

TVM is a best friend to savers, but it’s a bully to people in debt.

When you buy a $500 game console on a credit card and only pay it back “later,” the bank uses the TVM formula against you. They charge you interest, meaning that $500 today could turn into $700 or $1,000 in debt if you wait too long to pay it off.

- The Lesson: Use TVM to earn money, don’t let the banks use it to take yours!

How to Use TVM to Get Rich (Your Action Plan)

Now that you know the secret, how do you use it? It’s as simple as A-B-C:

- A. Start Early: Even if you only have $5, put it to work today. Time is more powerful than the amount of money you start with.

- B. Look for Interest: Don’t let your money sleep. Put it in a place where it earns “rent” (interest), like a high-yield savings account or an index fund.

- C. Think in “Future Dollars”: Before you buy something expensive, ask yourself: “If I invested this $100 today, how much would it be worth in 10 years?” Sometimes, that $100 pair of shoes is actually “costing” you $500 in future wealth!

Is the Time Value of Money just another word for Interest?

Not quite, but they are cousins! Interest is the tool that makes your money grow. Time Value of Money is the rule that says because of that growth, having money now is better than having it later. Think of TVM as the “Why” and Interest as the “How.”

Does TVM mean I should never save cash?

Saving cash is great for emergencies (like a flat tire). But for long-term goals, “cold hard cash” actually loses value because of inflation. To grow your wealth, you want your money to be “active” (invested) rather than “lazy” (sitting under a mattress).

Why do banks care about the Time Value of Money?

Banks are experts at TVM. When they lend you money for a car or a house, they are giving up their “today money.” They charge you interest to make sure that when you pay them back in the future, the money they get back is worth more than what they gave you.

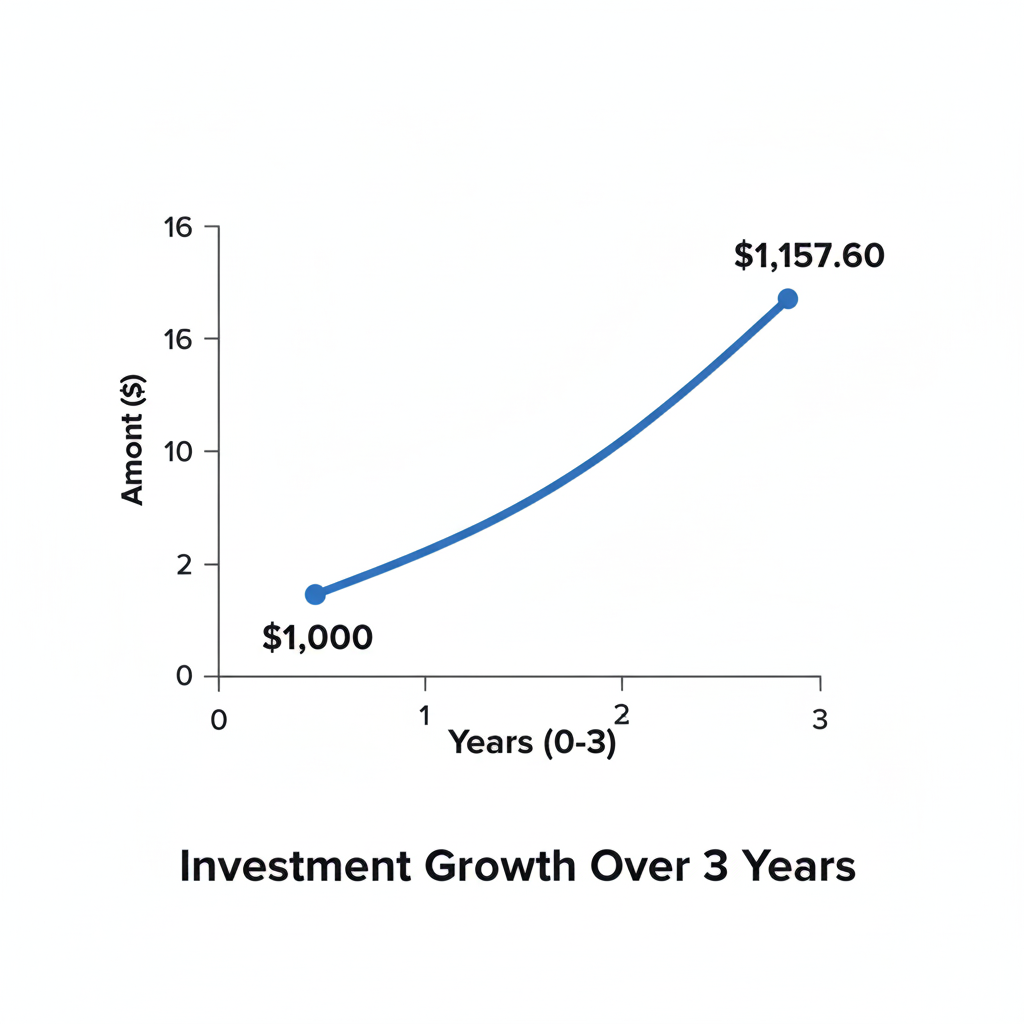

How much of a difference does 1 or 2 years really make?

A huge difference! Because of something called Compounding (which we will cover in our next post!), the money you save in your early years grows the most. Missing even just a year or two of growth can cost you thousands of dollars by the time you retire.

Can TVM be used for things other than money?

Yes! You can think of your time and skills the same way. Learning a new skill today is worth more than learning it in five years because you have more time to use that skill to improve your life.

Class Review: What Did We Learn?

Before you go, let’s do a quick “recap” of the secret to the Time Value of Money. If you remember nothing else, remember these four things:

- A Dollar Today > A Dollar Tomorrow: Because you can invest money today, it is always more valuable than money you have to wait for.

- Time is a Multiplier: The longer your money has to grow, the bigger the “Future Value” becomes. This is why starting early is your greatest advantage.

- Inflation is the “Thief”: If your money isn’t growing, it’s actually shrinking because prices for things like pizza and toys go up over time.

- The Wealth Formula: Wealth is created by combining Money + Growth (Interest) + Time.

Conclusion: Your Future Self is Waiting

The Time Value of Money is more than just a math equation from a Harvard classroom; it is the key that unlocks the door to your financial freedom. By understanding that time is just as important as the amount of money you save, you have already taken a bigger step than most adults!

Your Action Step for Today: Look at your savings. Is your money “sleeping” under a mattress, or is it “working” in an account where it can grow? Even starting with $5 today is better than starting with $500 five years from now.

What’s your biggest takeaway from today’s lesson? Drop a comment below and let’s discuss!

Leave a Reply