Have you ever walked into a grocery store and felt like your $100 bill just doesn’t buy as much as it used to? You aren’t imagining things. That “shrinking” feeling has a name: Inflation.

At Money Cornucopia, we believe you shouldn’t need a PhD in Economics to understand your wallet. If Compound Interest is the “Engine” that builds your wealth, then Inflation is the “Invisible Thief” trying to take a piece of it.

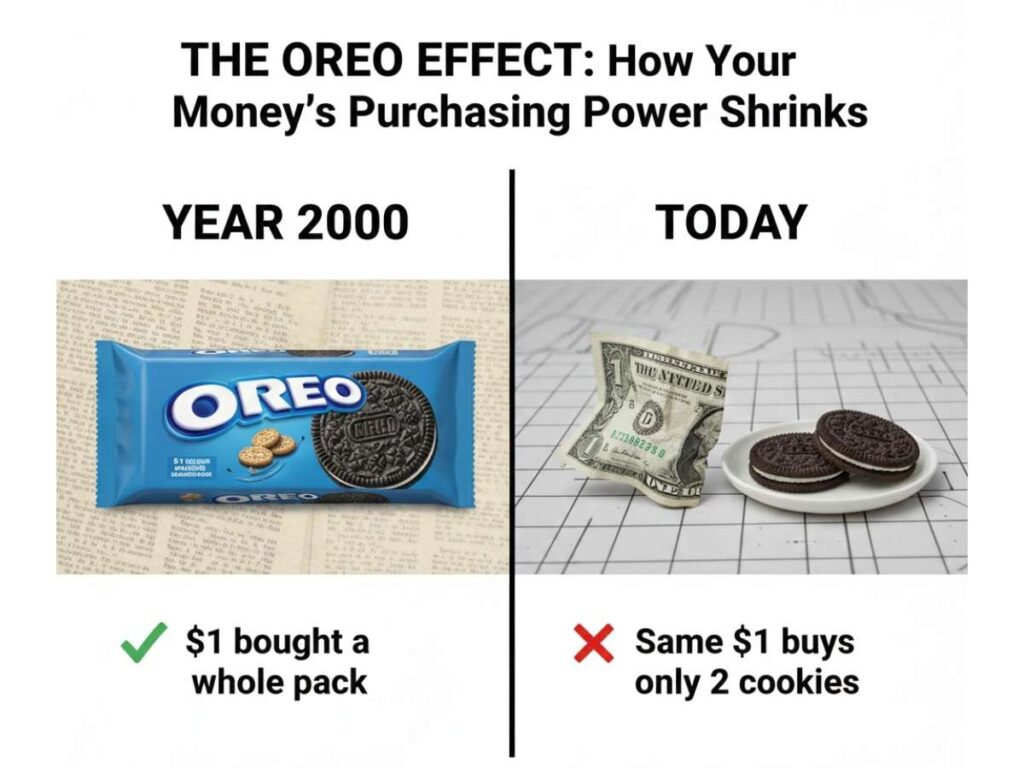

The Oreo Cookie Example

To understand inflation, let’s look at everyone’s favorite snack: The Oreo.

Imagine it is last year, and you have $1.00. You walk into the store, and one pack of Oreos costs exactly $1.00. Your dollar has the “power” to buy that whole pack.

Now, let’s fast-forward to today. You go back to the same store with the same $1.00 bill. But now, the price of Oreos has gone up to $1.10.

- What happened? The Oreos didn’t get bigger. The cream didn’t get thicker.

- The Reality: Your dollar didn’t change its shape, but it lost its Purchasing Power. It can now only buy about 90% of that pack of cookies.

Why Does This Matter?

Inflation is simply the rate at which the general prices for goods and services rise. When inflation goes up, every dollar you own buys a smaller percentage of a good or service.

This is why just “saving” money in a jar or a basic bank account can actually be risky. If your money is sitting still while prices are moving up, you are technically getting poorer every year.

How Do We Measure Inflation? (The Giant Shopping Basket)

If the price of Oreos goes up, is that “Inflation”? Not necessarily. Sometimes just one thing gets expensive because of a bad harvest or a factory issue.

To measure real inflation, economists don’t just look at one cookie; they look at a Giant Shopping Basket filled with everything a normal person buys in a month.

What is the CPI (Consumer Price Index)?

The Consumer Price Index, or CPI, is basically a monthly “receipt” for this imaginary basket. Every month, the government checks the prices of hundreds of items, including:

- Groceries: Bread, milk, and eggs.

- Energy: The gas in your car and the electricity in your home.

- Shelter: What it costs to rent an apartment or pay for a house.

- Services: Things like haircuts, car repairs, and doctor visits.

How it works (The Math made Simple):

Imagine the “Basket of Goods” cost exactly $1,000 last year. If that same basket costs $1,030 today, then the Inflation Rate is 3%.

Think of it this way: The CPI is like a thermometer for the economy. If the “temperature” (price) of the basket is rising too fast, the economy has a fever!

Is Your Savings Account Actually Losing Money? (The Real Return)

Most people feel happy when they see their bank account balance go up. If you have $1,000 and the bank gives you $10 in interest, you feel richer, right?

But here is the “Harvard-level” secret: To know if you are actually getting richer, you have to look at the Real Return.

The Race: Interest vs. Inflation

Think of your money like a runner in a race.

- Interest is how fast your money is running forward 🏃♂️.

- Inflation is how fast the finish line is moving away from you 🚩.

If your money runs at 2 miles per hour, but the finish line moves away at 3 miles per hour, you are actually getting further away from your goals!

The “Back-of-the-Napkin” Formula:

You don’t need a fancy calculator for this. Just use this simple subtraction:

Your Interest Rate — The Inflation Rate = Your Real Return

Example:

- Your bank pays you 1% interest.

- Inflation (the cost of stuff) goes up by 3%.

- 1% – 3% = -2%

Even though your bank account balance looks bigger, you can actually buy 2% less stuff than you could last year. You are “losing” money even while you’re “saving” it.

How to Use This to Build Your “Cornucopia”

This is exactly why we talk about investing. To build true wealth, you need to find places to put your money where the growth is higher than the inflation rate.

If inflation is the “Thief,” then a high Real Return is your “Security Guard.”

How to Build Your “Inflation Shield”

Now that you know the “Invisible Thief” is out there, how do you stop him? You can’t stop inflation across the whole country, but you can protect your own Money Cornucopia.

Here are three simple ways to keep your purchasing power strong:

- Don’t Keep Too Much “Idle” Cash: While having an emergency fund is smart, keeping all your money in a jar or a 0% savings account is a slow way to lose wealth.

- Invest in Productive Assets: Historically, things like Stocks (owning a piece of a company) and Real Estate (owning land) tend to grow faster than inflation over the long term. As prices go up, companies charge more and rents rise, which protects your value.

- Invest in Yourself: Your skills and your ability to earn an income are “inflation-proof.” If you are a great plumber or a skilled programmer, your “price” (your salary) will usually go up along with the cost of living.

Wait! Why can’t the government just print more money?

It’s the most logical question in the world: “If prices are going up and people are struggling, why doesn’t the government just print more cash and give it to everyone?”

It sounds like a magic fix, but there is a golden rule in finance: Money is only a “coupon” for stuff. If you print more coupons without making more “stuff” (like bread, cars, or houses), the coupons simply become less valuable.

The Island Auction Example 🏝️🥖

Imagine you are on a small island with 10 people. There is only one loaf of bread left for sale.

- Scenario 1: Everyone on the island has exactly $1. When the auction starts, the highest anyone can bid is $1. The price of bread stays at $1.

- Scenario 2: A helicopter flies over and drops $1,000 for every person. Everyone feels “rich!” But when the auction for that same loaf of bread starts, everyone bids higher and higher because they have so much cash. Suddenly, that same loaf of bread sells for $1,000.

The Result: You have 1,000 times more money, but you still only have one loaf of bread. You aren’t richer; the money just lost its “oomph.”

When a government prints too much money too fast, it’s like that helicopter drop. It leads to Hyperinflation, where prices move so fast that money becomes practically worthless.

Frequently Asked Questions

Is inflation always a bad thing?

Not necessarily! A little bit of inflation (usually around 2%) is considered healthy for the economy. It encourages people to spend and invest their money rather than just sitting on it.

Why don’t we just stop printing money to stop inflation?

It’s a balancing act. If the government stops the money flow too suddenly, it can cause “Deflation,” which can lead to businesses closing and people losing jobs. The goal is a “Goldilocks” economy—not too hot, not too cold.

How often is inflation measured?

In the U.S., the Bureau of Labor Statistics releases the CPI (Consumer Price Index) report every single month.

What is the best thing to own during high inflation?

Historically, “Hard Assets” like real estate or diversified index funds (stocks) have been the strongest “shields” against a rising cost of living.

Why can’t the government just print more money to stop poverty?

Printing money doesn’t create more “stuff” (like food, clothes, or houses); it only creates more “paper.” If everyone has more money but the amount of goods stays the same, prices simply skyrocket to match the new amount of cash. This is called Hyperinflation, and it actually makes poverty worse because prices rise faster than people can spend.

Does my savings account beat inflation?

Usually, no. Most basic savings accounts pay very low interest (like 0.01% or 1%). If inflation is at 3%, you are technically losing 2% of your wealth every year. This is why we focus on Real Return.

Key Takeaways: Putting it All Together

- Inflation is the “Value Thief”: It is the steady increase in prices over time, which means your money loses “purchasing power.”

- The TVM Connection: Inflation is the reason why the Time Value of Money (TVM) matters so much; a dollar today is worth more than a dollar tomorrow because today’s dollar hasn’t been “shrunk” by inflation yet.

- Beating the Race: To grow your wealth, your Compound Interest rate must be higher than the inflation rate. If inflation is 3% and your bank pays 1%, you are technically losing money!

- Invest to Protect: Investing is the “Shield” that helps you maintain your lifestyle, ensuring that your future self can still afford the same basket of goods you buy today.

Don’t Let the “Invisible Thief” Win! 🛡️

Now that you know how inflation works, it’s time to decide how you’re going to fight back. Are you growing your wealth, or is the thief taking a bite out of your savings every single month?

Join the Conversation: We are building a community of “Wealth-Builders” over on the [Money Cornucopia Facebook Page]. Follow us there for daily “money hacks,” simple charts, and a place to ask your questions!

What’s your “Inflation Story”? Is there a specific item (like eggs, gas, or rent) that has surprised you lately? Head over to our latest Facebook post and let us know!

Leave a Reply