Have you ever felt like a $100 purchase actually cost you much more than $100? If you’ve been following our “Money Cornucopia” curriculum, you already know that Inflation makes your money shrink over time. But there is another “hidden price” that affects every single decision you make: Opportunity Cost.

In the world of finance, every time you choose to do one thing with your money, you are automatically choosing not to do something else.

What is Opportunity Cost?

Think of every dollar you own as a traveler standing at a fork in the road. It can only go down one path. If you send that dollar down “Spending Street” to buy a coffee, it can never go down “Investment Avenue” to earn Compound Interest.

Opportunity Cost is simply the value of the “path not taken.” It is the benefit you give up when you choose one option over another.

Why It Matters for Your Wealth

Most people only look at the price tag when they buy something. But a “Beginner’s Guide to Financial Logic” requires you to look at the Time Value of Money (TVM).

- The Price Tag: $1,000 for a new TV.

- The Opportunity Cost: The $5,000 that $1,000 could have become in 20 years if it had been invested instead.

When you understand this concept, you stop asking, “Can I afford this?” and start asking, “Is this the best use for this dollar right now?”

Real-World Examples: The Price vs. The Potential

To master the Foundations of Financial Logic, you have to train your brain to see what isn’t there. Here are three common scenarios:

1. The “Daily Treat” vs. The “Future Fortune”

Imagine you spend $5 every work day on a premium coffee.

- The Price Tag: $5.

- The Opportunity Cost: That $5 per day (about $100 a month) could be put into an investment account. Using Compound Interest, that $100 a month could grow to over $50,000 in 20 years.

- The Lesson: You aren’t just “buying a coffee”; you are choosing to “not have $50,000” later.

2. The New Car vs. The Used Car + Investment

Suppose you are deciding between a brand-new car for $40,000 or a reliable used car for $25,000.

- The Choice: Buying the new car.

- The Opportunity Cost: The $15,000 difference. If you invested that $15,000, the Time Value of Money (TVM) tells us it would be worth much more in the future.

- The Lesson: The “cost” of the new car smell is the thousands of dollars in lost growth from that $15,000.

3. Time: Your Most Limited Resource

Opportunity cost isn’t just about cash; it’s about your time.

- The Scenario: Spending 4 hours driving across town to save $20 on a grocery deal.

- The Opportunity Cost: What else could you have done with those 4 hours? You could have learned a new skill, rested, or worked a side hustle.

- The Lesson: If your time is worth $25/hour, you just “spent” $100 worth of time to save $20. You actually lost $80!

How to Calculate Opportunity Cost

You don’t need a complex calculator for this. Just use this simple mental formula:

Opportunity Cost = (Value of the Best Option NOT Chosen) – (Value of the Option Chosen)

If the number is high, you might want to rethink your decision!

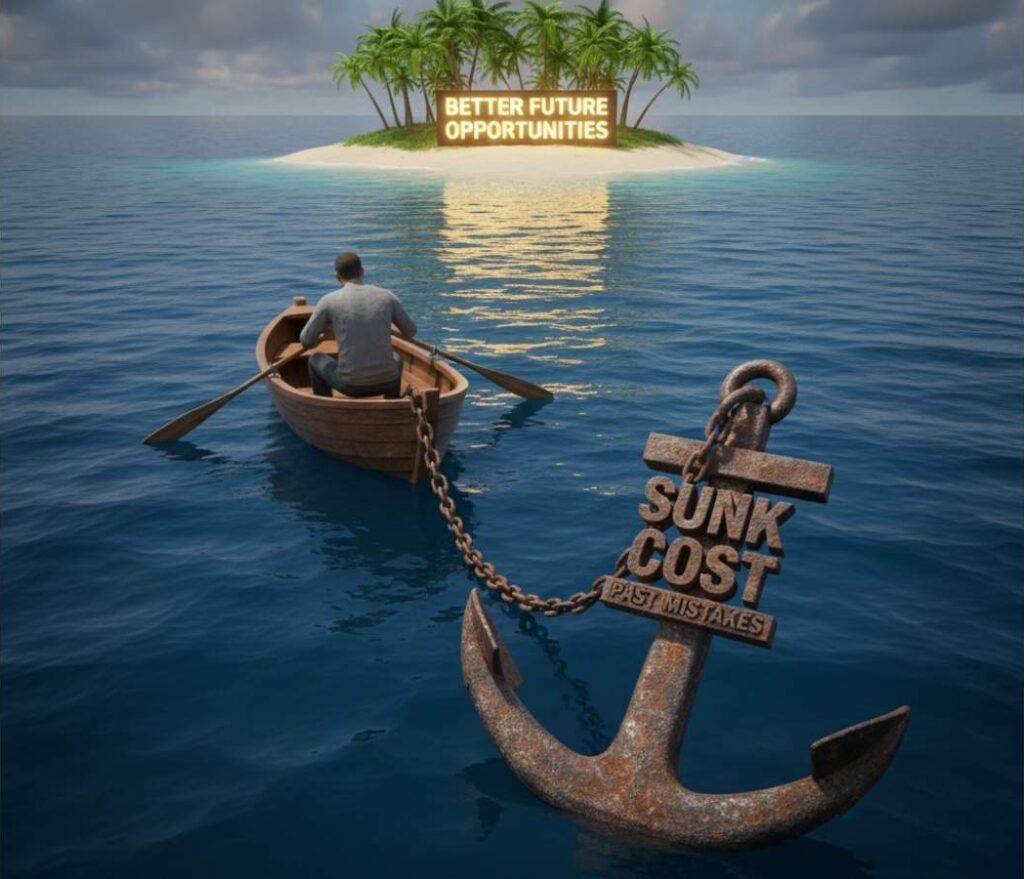

The Trap: Sunk Cost vs. Opportunity Cost

One reason people struggle with Opportunity Cost is a mental trap called the “Sunk Cost Fallacy.”

A “Sunk Cost” is money or time you have already spent and cannot get back. Most people keep pouring money into a bad investment or a broken car because they “already put so much into it.”

- The Sunk Cost Mindset: “I have to finish this expensive meal even though I’m full because I already paid for it.”

- The Opportunity Cost Mindset: “I already paid for the meal, but if I keep eating, I’ll feel sick and lose my afternoon productivity. My time and health are more valuable than the ‘cost’ of leaving food on the plate.”

By focusing on the path ahead (the Opportunity Cost) rather than the money already gone (the Sunk Cost), you make much smarter choices.

Opportunity Cost in Your Career and Lifestyle

It isn’t just about what you buy at the store. It affects your biggest life milestones in Semester 1:

- The “Stay or Go” Career Move: If you stay in a job that pays $50,000 when you could be making $70,000 elsewhere, your “Opportunity Cost” is $20,000 a year. Is the comfort of your current job worth $20,000?

- Education: Choosing to go to college for four years means you aren’t earning a full-time salary during those years. The “cost” of the degree is the tuition plus the four years of lost wages.

- Renting vs. Buying: If you put $50,000 into a down payment for a house, the opportunity cost is what that $50,000 could have earned in the stock market (our next topic in Semester 2!).

Your “Opportunity Cost” Checklist

Before you make your next big financial move, ask yourself these three simple questions:

- What am I giving up? (If I buy this today, what can I not buy or invest in tomorrow?)

- Is there a better “Future Use” for this money? (Think back to the Compound Interest lesson—would this $100 be better as $1,000 in the future?)

- Am I deciding based on the past or the future? (Avoid the Sunk Cost trap!)

At a Glance: The Opportunity Cost Summary

If you only have 30 seconds, here is what you need to know:

- Definition: Opportunity cost is the value of what you give up when you make a choice.

- The Concept: Every dollar and every hour can only be spent once. If you choose Path A, the “cost” is everything you would have gained from Path B.

- Why it Matters: It helps you move beyond looking at “price tags” and starts you thinking about “potential growth”.

- The Goal: To ensure the path you do choose provides more value than the one you leave behind.

Frequently Asked Questions (FAQs)

Is opportunity cost the same as a financial loss?

No. A loss is when you actually lose money you already had. Opportunity cost is a “hidden” cost because it represents the profit or benefit you could have had but didn’t get because you chose a different path.

Is opportunity cost always about money?

Not at all. In our blog, we emphasize that time is your most valuable asset. The opportunity cost of watching 3 hours of TV might be the sleep you didn’t get or the book you didn’t read.

How do I know if an opportunity cost is “too high”?

If the “next best alternative” (like investing in the stock market) would have given you a significantly better long-term result than your current choice, the opportunity cost is high. This is why we link this concept to Compound Interest.

Can I avoid opportunity cost?

No. Because resources (time and money) are limited, every single choice has an opportunity cost. The goal isn’t to avoid it, but to be aware of it so you can make the best choice possible.

Mastering the Foundations

Understanding Opportunity Cost marks the completion of your first semester in the Architecture of Wealth. You now have the four essential “mental models” to view the world like a pro:

- TVM: You know money has a time dimension.

- Compound Interest: You know how to multiply that money.

- Inflation: You know how to protect that money from shrinking.

- Opportunity Cost: You know how to choose the right path for every dollar.

By looking at life through these lenses, you are no longer just a “spender”—you are an architect of your own wealth. You are ready to stop worrying about what things cost today and start focused on what your life can become tomorrow.

Leave a Reply